Completing a Mortgage Recast

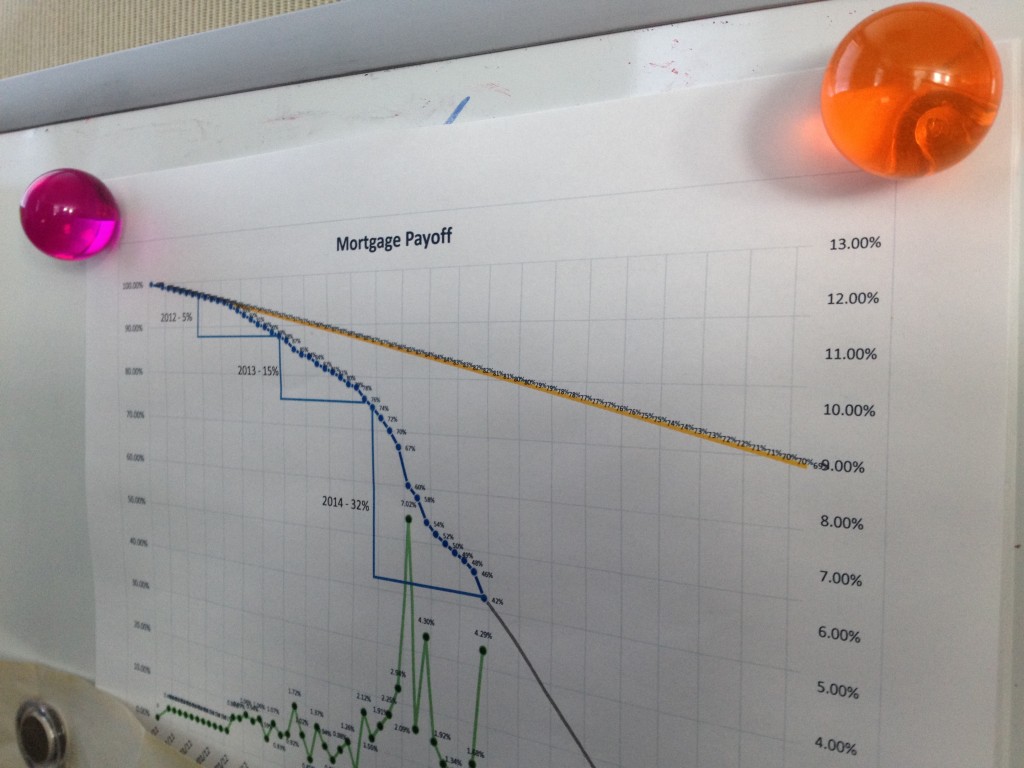

Last year we moved from Tennessee to Texas. We sold our paid-for house, and purchased a new house that was about 20% more expensive than the one we sold. Due to the timing and not having a credit score, we had to take out a mortgage for the full amount of the new house before the sale completed on our old house. We had been […]

Completing a Mortgage Recast Continue Reading »